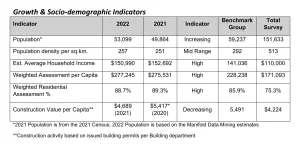

- Council receives a report tomorrow laying out key 2022 financial indicators that will inform the 2023 budget process and any possible tax increases.

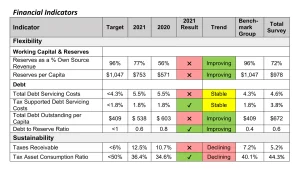

- No new debts were taken on in 2021/2022, outstanding debt and debt cost trends continue to improve. The Town services slightly more debt compared to similar municipalities, but it is covered by reserves and well below municipal and provincial limits.

- While trends are positive, Stouffville’s reserves lag ideal levels, and the Town currently faces a $7 million infrastructure servicing gap with many projects awaiting funding.

- To help address low reserves, Staff is recommending Council reinstate a past 3% capital levy which was cut throughout the pandemic.

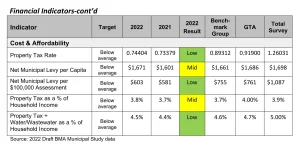

- We have one of Ontario’s highest average household income levels and the seventh lowest property tax rate in the GTHA. Staff believe there’s room for levy increases while maintaining affordability.

- Stouffville continues its struggle offsetting dependence on our residential tax base, collecting <12% of its tax revenues from non-residential sources and highlighting the Town’s need to increase local employment activity.